County interest revenues, rates near zero

DAVE MOSIER/independent editor

Although Van Wert County Treasurer Bev Fuerst is pleased that permissive tax and other tax revenues are showing a rebound, she also wouldn’t mind if another part of the revenue picture — interest revenue — would do the same.

County tax revenues have increased every month for the past year and a half, something that has helped county officials balance their budget again — even with the state cutting local government funds and other financial assistance.

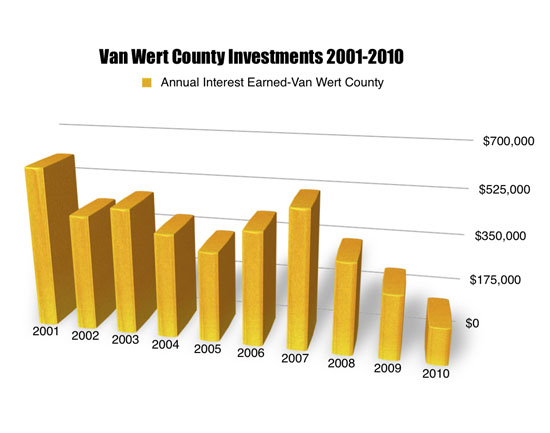

Interest rates, on the other hand, have taken a nosedive from the 6 and 7 percent seen back in 2000 to oftentimes less than 1 percent when Certificates of Deposit were renewed this year. Revenues also have decreased considerably. In the eight years from 2000 to 2007, annual interest revenues averaged $469,800. That includes a “bad spell” in 2005 where interest rates decreased to 2.27 percent, but gradually rose again.

However, since the recession hit in 2008, those numbers have fallen considerably. In 2008, the county earned $342,901.93 from interest. That number dropped $100,000 to $241,307.83 and another $100,000 in 2010, to $136,925.16.

Fuerst says this year is likely to be even worse than 2010, with interest rates on CDs being renewed this year continuing to decline, from 0.85 percent on a CD renewed in May to just 0.20 percent for the last CD renewed.

“The rates are just not there,” Fuerst said, adding that those rates are only good if you can get a financial institution to take the money.

The county treasurer said the problem is that banks and other financial institutions aren’t loaning out the money they have on hand, so there isn’t much incentive for them to take in even more money — especially since the Federal Reserve would likely charge them an additional fee for doing so.

“A lot of them won’t approach you because they don’t want the money,” Fuerst added.

Unfortunately, that’s a problem typical to recessions and other economic downturns. Normally, financial institutions take the money government agencies and others invest with them and then put that money back in circulation in the form of loans and other interest-bearing investments. But with the downturn, financial institutions have tightened their loan guidelines and fewer customers can get loans, even though the interest rate for loans is also lower than it has been for decades.

“It’s a sad scenario and it hasn’t turned around,” Fuerst said of the interest rate situation, and added that those trying to predict when an upturn in interest rates may occur have moved the timeline back to 2013.

If there’s a bright spot in the interest situation, the treasurer said, it’s that rates can’t decrease much more. “I can’t see them going much lower,” Fuerst said, adding that other political subdivisions are having the same problems as the county in finding reasonable interest rates for their investments.

Fortunately, county taxpayers are pretty good at paying their taxes, with tax delinquencies not a big problem for the county.

“Van Wert County residents are very responsible people,” noting that delinquencies total approximately $500,000 out of $22 million collected overall.

“I was just totally shocked,” Fuerst. “For the economy as bad as it is, it’s a good thing for the county to have such a low delinquency rate.”

POSTED: 10/24/11 at 1:50 am. FILED UNDER: News