Submitted information

Rob Davis has gained a wealth of experience and served in a variety of positions at The Marsh Foundation. His newest role is that of admissions and training specialist. Previously, he served as a clinical case manager, school family teacher and group home family teacher.

His career at The Marsh Foundation has spanned more than 20 years, but his passion for working with children began in college at The Ohio State University where he graduated with a bachelor’s degree in psychology. In Columbus, he began working with autistic children and their families as an ABA therapist before moving back to Van Wert to establish his career at The Marsh Foundation.

According to executive director of Child and Family Services, Kelly Gross, Davis’ promotion comes as a result of his exceptional dedication, hard work and demonstrated expertise in his previous role as case manager.

“Rob has been an invaluable member of our team for more than 20 years, consistently exceeding expectations and contributing significantly to our success,” she said. “He has shown exceptional leadership qualities, a strong commitment to our mission, and a deep understanding of the necessary qualifications to successfully be the admissions and training specialist.”

Davis’ new position will require him to use his experience to not only review referrals and coordinate youth admissions, but also oversee staff development training.

“With his wealth of experience, pre-existing connections with stakeholders, and a passion for helping others succeed, we have full confidence that he will excel in this position and make significant contributions to The Marsh Foundation’s continued growth and success,” Gross said.

Davis said he is excited to continue serving The Marsh Foundation and its mission in a new capacity.

“As the admissions and training specialist, I will carry on the mission of The Marsh Foundation to inspire hope, to teach and to care for children and families,” he said. “I am committed to continuing The Marsh Foundation’s legacy with all the dedicated employees on this beautiful campus.”

Davis lives in Van Wert with his wife, son and daughter. When he’s not working, he enjoys spending time with them, seeing new places, visiting family or spending time at relaxing campsites. When he needs free time to himself, he almost always finds himself outdoors.

The Marsh Foundation is a not-for-profit children’s services agency that provides services for youth and families in a variety of settings. Services include residential care, family foster care (ages 0-17), adoption and independent living services. Located in Van Wert, the organization is licensed to provide on-campus services for up to 30 children, offers an on-campus school for grades 2-12, and provides a variety of clinical services to campus residents, foster care children and community members throughout western Ohio.

POSTED: 07/23/24 at 5:06 am. FILED UNDER: Business

VW independent staff/submitted information

Central’s Educational & Charitable Foundation has announced its 2024 Scholarship Program recipients.

The program rewards graduates pursuing educational degrees supporting careers in the property and casualty insurance industry. The scholarship provides up to $5,000 annually to each student, is renewable for up to three years, and may be used towards tuition, books, other related school fees, and room and board.

Cadence Cook is a graduate of Crestview High School. She plans to attend Miami University in Oxford this fall, majoring in Psychology. After obtaining her undergraduate degree, Cadence plans to attend law school. In high school, she was a member of the Honor Society, completing multiple honor classes and a College Credit Plus Government class. Cadence cheered for the varsity football and basketball teams and received eight scholar-athlete awards. She has also received several community awards, including the Franklin B. Walter All-Scholastic Award, the Elks Student of the Month Award, and was a finalist for the 2024 YWCA Scholarship for Young Women. Cadence is the daughter of Julie and Shawn Cook.

Hudson Myers graduated from Wayne Trace High School. He plans to attend Purdue University in Fort Wayne this fall, majoring in Business Management. Hudson was enrolled in several post-secondary courses and maintained honor roll status every quarter of his high school career. He was an active member of the National Honor Society and Student Council, where he held the titles of secretary and vice-president. He was also a Student Ambassador for students new to Wayne Trace. Outside academics, Hudson participated in basketball, football, and track and field, and completed volunteer work through NHS and his community church. Hudson is the son of Mike and Anne Myers.

Other winners were Antwerp High School graduate Leila Spyker; Fort Recovery High School graduate Carson Grube; Ford Cooper of Frisco, Texas, and Noah Swallow of Shawnee High School.

Renewal scholarships of $5,000 each were awarded to Audrey Carter, Brandon Renner, Dylan Buzard, Evan Hoersten, Gwenyth Prince, Ian Rex, Jacob Wasson, Jeff Li, Kaelan Swallow, Paul Adams, Shawn Tierney, and Storm Tracy.

Outgoing Marsh Foundation Executive Director Kim Mullins chats with Marsh Trustee Gary Corcoran during a retirement party held in her honor earlier this week. Mullins retiring after a 29-year career at the Marsh Foundation, including 21 years as executive director. Scott Truxell/VW independent

POSTED: 06/28/24 at 8:40 pm. FILED UNDER: Business

VW independent staff/submitted information

First Financial Bank and associates teamed up with community residents to collect over 4,000 books in Ohio, Indiana, Kentucky and Illinois during its recent book drive, May 6-24, including 230 in Van Wert and Delphos, contributing to financial literacy in the neighborhoods it serves.

Books were collected in First Financial’s locations in northwest Ohio and at financial centers in its four-state footprint. First Financial will donate the books to Haven of Hope and the YWCA, plus schools, libraries and other community-focused organizations in each of its other communities.

“We appreciate the incredible turnout from community members who pitched in to help with this book drive, because our combined effort will have a positive impact on financial literacy for years to come in the people who receive these volumes,” said Roddell McCullough, chief corporate responsibility officer for First Financial Bank.

While collecting books for the community, First Financial associates were also distributing a list of books and articles to support growth in financial literacy for all age groups. Titles included, “A Bike Like Sergio’s” for elementary students, “O.M.G.: Official Money Guide for Teenagers” for high school students and “The Art of Money: A Life-Changing Guide to Financial Happiness” for adults. Selections on this list cover the entire spectrum of life. The list will continue to be available in local First Financial locations upon request.

POSTED: 06/28/24 at 8:40 pm. FILED UNDER: Business

Submitted information

The Van Wert community is set to expand as Jennings Crossing, a new residential subdivision, officially breaks ground in early July. Located on the along Jennings Road along the southeast side of town, Jennings Crossing offers a community-focused living environment with 42 beautifully designed townhouse units. A ceremonial ground breaking ceremony was held on Monday.

Jennings Crossing is crafted to provide residents with modern comforts and a maintenance-free lifestyle. Each townhouse unit boasts contemporary architectural design, high-quality finishes, and energy-efficient features, ensuring a comfortable and sustainable living experience.

One of the key highlights of Jennings Crossing is the Homeowners Association (HOA), which is dedicated to maintaining the community’s pristine appearance and ensuring a hassle-free living environment for all residents. The HOA will manage essential services such as mowing, snow removal, landscaping cleanup, fertilizer/herbicide treatments, and trash collection.

“We are thrilled to introduce Jennings Crossing to the Van Wert community,” said Warren Straley, Jennings Crossing developer. “Our goal is to create a welcoming and vibrant neighborhood where residents can enjoy the benefits of modern living without the stress of property maintenance.”

Jennings Crossing is situated with easy access to local amenities, including shopping centers, parks, churches, and schools, making it a perfect place for families, young professionals, and retirees alike.

Prospective homeowners are invited to visit straleyrealty.com to explore the various floor plans available at Jennings Crossing. For sales inquiries and more information about the subdivision, visit straleyrealty.com or contact Straley Realty at 419.238.HOME.

POSTED: 06/26/24 at 3:37 am. FILED UNDER: Business

Submitted information

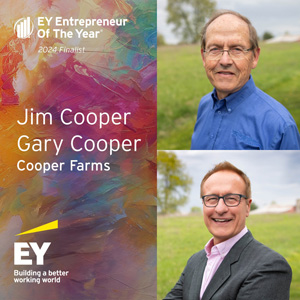

OAKWOOD — Ernst & Young LLP (EY US) recently announced that Jim Cooper and Gary Cooper of Cooper Farms were named finalists for the Entrepreneur Of The Year® 2024 Michigan and Northwest Ohio Award. Now in its 38th year, Entrepreneur Of The Year is the preeminent competitive business award for audacious leaders who disrupt markets, revolutionize sectors and have a transformational impact on lives. Over the past four decades, the program has recognized the daring entrepreneurs with big ideas and bold actions that reshape our world.

Jim and Gary are finalists in a pool of 34 regional entrepreneurs from 30 companies selected by an independent panel of judges. The candidates were evaluated based on their demonstration of building long-term value through entrepreneurial spirit, purpose, growth and impact, among other core contributions and attributes.

“My brother Jim and I are honored to be nominated for this prestigious award,” said COO Gary Cooper. “When Jim and I joined the company 50 years ago, we never could have guessed where it would be today. We’re happy to be maintaining Cooper Farms as a family owned and operated company that continues to grow.”

Entrepreneur Of The Year honors many different types of business leaders for their ingenuity, courage and entrepreneurial spirit. The program celebrates original founders who bootstrapped their business from inception or who raised outside capital to grow their company; transformational CEOs who infused innovation into an existing organization to catapult its trajectory; and multigenerational family business leaders who reimagined a legacy business model to fortify it for the future.

Regional award winners will be announced on Thursday, June 20, during a special celebration and will become lifetime members of an esteemed community of Entrepreneur Of The Year alumni from around the world. The winners will then be considered by the National judges for the Entrepreneur Of The Year National Awards, which will be presented in November at the annual Strategic Growth Forum, one of the nation’s most prestigious gatherings of high-growth, market-leading companies.

In addition to Entrepreneur Of The Year, EY US supports other entrepreneurs through the EY Entrepreneurial Winning Women program and the EY Entrepreneurs Access Network to help connect women founders and Black and Hispanic/Latino entrepreneurs, respectively, with the resources, network and access needed to unlock their full potential.

Founded in 1986, Entrepreneur Of The Year has celebrated more than 11,000 ambitious visionaries who are leading successful, dynamic businesses in the US, and it has since expanded to nearly 80 countries and territories globally.

The US program consists of 17 regional programs whose panels of independent judges select the regional award winners every June. Those winners compete for national recognition at the Strategic Growth Forum in November where national finalists and award winners are announced. The overall national winner represents the US at the World Entrepreneur Of The Year competition.

POSTED: 06/14/24 at 9:00 pm. FILED UNDER: Business

The Van Wert Chamber of Commerce marked the relocation of Red Oak Realty with a ribbon cutting at their new location at 905 S. Shannon St. Van Wert. Red Oak Realty was founded in February of 2021 by managing partners Amber Davis and Josh Ebbing. Currently, Ebbing is the principal broker and Davis is the management level realtor. Photo submitted

POSTED: 06/05/24 at 9:04 am. FILED UNDER: Business

VW independent staff/submitted information

MIDDLE POINT — In celebration of the 60th anniversary of the beloved television series “The Munsters,” the Van-Del Drive-In will host a special event featuring a screening of the classic film “Munster, Go Home.” Fans are in for an extra treat as Butch Patrick, who played Eddie Munster, will make a special appearance to commemorate this milestone occasion.

On display will be two iconic vehicles from The Munsters television series – Dragula and Eddie Chopper.

The event is scheduled for Monday, June 10, and promises to be an unforgettable evening for fans of all ages. “The Munsters,” which originally aired in 1964, has remained a beloved part of American pop culture, charming audiences with its humorous take on a family of benign monsters living in suburban America.

“We are excited to celebrate the 60th anniversary of ‘The Munsters’ with our community and fans from afar,” said Ronnie Dunn, Van-Del Drive-In Theatre Manager. “Having Butch Patrick join us for this special screening of ‘Munster, Go Home’ makes the event even more memorable. It’s a fantastic opportunity for fans to relive the magic of the show and meet one of its beloved stars.”

Patrick will be available for a meet and greet from 7:30-9:30 p.m. Monday at the Van-Del Drive-In.

Patrick, who portrayed the iconic character Eddie Munster, expressed his enthusiasm about the event.

“I’m thrilled to be part of this 60th-anniversary celebration,” he said. “’The Munsters’ has had a lasting impact on so many people, and it’s wonderful to see its legacy continue. I look forward to meeting the fans and sharing this special moment with them.”

The Van-Del Drive-In will provide a nostalgic setting for the screening, allowing fans to enjoy “Munster, Go Home” in a classic drive-in theater environment. The gates will open at 7:30 p.m. and the screening will begin at dusk.

The film, which was released in 1966, features the Munster family as they embark on a hilarious adventure to England, filled with spooky fun and family-friendly comedy. Tickets for the event are $10 per carload and available for purchase on the Van-Del Drive-In website and at the gate. Attendees are encouraged to arrive early to secure a prime parking spot and participate in pre-screening activities, including opportunities for selfie photos and Munster merchandise.

POSTED: 06/05/24 at 8:58 am. FILED UNDER: Business

Submitted information

OhioHealth Van Wert Hospital is celebrating the return of its volunteer program after it was paused due to the COVID-19 pandemic.

Volunteers are vital to the hospital by helping with various tasks which could include greeting patients, helping patients and visitors navigate the hospital, wheelchair assistance, and re-stocking supplies.

“Volunteering gives people the opportunity to help make a difference in people’s lives and is a great way to give back to our community,” said Emily Lichtenberger from OhioHealth Van Wert Hospital’s volunteer services. “We’ve seen that it’s especially rewarding for our older volunteers because it provides a purpose, sense of fulfillment, and an opportunity to connect with others.”

Interested volunteers will go through training as part of an on-boarding process and can expect a time commitment of serving 2-4 hours a week.

Van Wert hospital is currently looking to add to its team of volunteers. For more information or to sign up reach out to Emily Lichtenberger by e-mail at Emily.Lichtenberger@ohiohealth.com.

POSTED: 05/24/24 at 1:54 pm. FILED UNDER: Business

VW independent staff/submitted information

Central Insurance reported a year of resilience and stability in the face of industry challenges during its annual policyholder meeting held Wednesday, May 8, at the company’s headquarters in Van Wert.

“Last year proved to be a challenging year for the insurance industry,” Chairman, CEO, and President Evan Purmort stated. “I am proud of our response to those challenges and steadfast in my belief that Central has never been better positioned to fulfill our promise to policyholders.”

Against a backdrop of unprecedented reinsurance cost increases, record-breaking catastrophic losses, and persistent inflationary pressures, Purmort noted the company responded with incredible fortitude.

“We leveraged our financial strength and grew our surplus—outperforming our peers in underwriting profit,” he said. “We doubled down on investments in our people, technology, and specialization. Lastly, we never lost sight of taking the opportunity to invest in our community. These accomplishments reflect our collective commitment to excellence as we continue to build for the future.”

Purmort touched on the company’s commitment to the local community through its $17 million investment in the restoration and revitalization of downtown Van Wert and $90,000 in scholarships awarded to support local students’ academic futures.

The meeting also marked the beginning of Evan Purmort’s tenure as Chairman of the Board following his election earlier this year. Evan Purmort succeeds Bill Purmort in the role, who recently stepped down as Chairman after a distinguished 45-year career at Central.

“Bill’s lifelong commitment to fulfilling our promise has laid a powerful foundation that will propel us forward,” Evan Purmort said. “As I step into the role of Chairman of the Board, I am deeply honored and committed to advancing Bill’s legacy of integrity, excellence, and service.”

(more…)POSTED: 05/23/24 at 3:36 am. FILED UNDER: Business